19 August 2014. Gamida Cell, a developer of therapies from umbilical cord stem cells, says the global pharmaceutical company Novartis is buying a 15 percent interest in the company, with an option to acquire the entire company later. The deal brings Gamida Cell, located in Jerusalem, Israel, $35 million immediately, with a total potential return of $600 million if the full acquisition goes through.

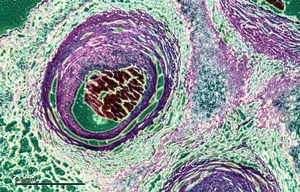

Gamida Cell designs therapies based on stem cells derived from umbilical cord blood, a potentially rich source of regenerative cells to treat blood-related diseases including anemia, leukemia, and lymphoma. A limitation of cord blood stem cells is the small number that can be generated at any one time. Gamida’s technology expands the number of available cells with epigenetic techniques — changes in gene expression outside of DNA — and cultures based on low molecular weight compounds.

The company’s lead product is StemEx, offered as an alternative when an exact bone marrow transplant cannot be found. Cord blood transplants do not require the same precise match as bone marrow. StemEx completed a late-stage clinical trial as a treatment for blood-related cancers leukemia and lymphoma.

Gamida Cell’s more recent technology applies nicotinamide, a derivative of vitamin B3 to expand the functionality of cultured cord blood stem cells. This technology is the basis for the company’s NiCord product, currently in early and intermediate stage clinical trials as a treatment for blood related cancers, as well as sickle-cell anemia.

Another nicotinamide-based product, CordBridge, completed preclinical tests as a treatment for acute radiation syndrome. A related NK Cells (for natural killer) product completed preclinical tests as an immunotherapy for solid tumor cancers.

Under the deal, Novartis will acquire 15 percent of Gamida Cell’s stock for $35 million. Should Novartis exercise the option to buy the entire company, Novartis will pay Gamida Cell’s shareholders — mainly other biotechnology and pharmaceutical companies, as well as venture investors — $165 million. The full-acquisition option will be available for a limited, but undisclosed, period of time, and is contingent on the achievement of certain milestones in the development of Gamida’s NiCord product in 2015.

If the full acquisition goes through, Gamida Cell’s shareholders will also be eligible for another $435 million in payments, based on reaching certain development and regulatory milestones, as well as royalties on sales.

Read more:

- Roche Acquiring RNA Medications Biotech Company

- Allied Minds, Bristol-Myers Squibb Form Life Science Venture

- Pfizer Acquires Baxter Vaccines Business

- Baxter Acquires Sickle-Cell Prevention Drug Developer

- Bristol-Myers Squibb, Biotech in Cancer Drug Discovery Deal

* * *

RSS - Posts

RSS - Posts

You must be logged in to post a comment.