Rahm Emanuel, the current mayor Chicago and former chief of staff to President Obama, once famously said, “You never want a serious crisis to go to waste.” The National Venture Capital Association (NVCA) has gone Emanuel one better, using highly selected bits and pieces from an industry survey to predict an imminent retreat by investors from funding U.S. life sciences companies, and then blame it all on the Food and Drug Administration (FDA).

NVCA’s media blitz began 6 October, when one of its committees released a survey called “Vital Signs: The Threat to Investment in U.S. Medical Innovation and the Imperative of FDA Reform,” which NVCA announced with a press release and news conference that day.

The survey results, as NVCA’s vice-president Kelly Stone grimly pointed out, show that “US venture capitalists are reducing their investment in biotechnology and medical device companies and shifting focus overseas to Europe and Asia, primarily due to regulatory obstacles at the Food and Drug Administration.” Since that announcement, industry commentators and analysts have repeated that meme, indicating one of America’s historically productive and entrepreneurial industries was failing due to roadblocks from a regulatory agency.

Even a cursory review of the results released by NVCA, however, shows enormous gaps in the data that hardly support such sweeping statements. Other reports and documents — in some cases from NVCA itself — suggest a challenging investment environment for the life sciences, but hardly the crisis NVCA would like you to believe is happening.

NVCA conducted the survey online from July to September 2011, with 259 NVCA member companies who invested previously in health care enterprises asked to take part. Of those 259 VC companies, 156 responded, for a 60 percent response rate.

For starters, the so-called “Vital Signs” report that generated so much attention isn’t much of a report, only a press release and set of data slides, not even a narrative discussion. Moreover, NVCA has yet to release to the public the full set of data from the survey, showing the wording of the questions as well as all responses to the questionnaire items, and to whom the questions were asked — all respondents or specified subsets. These pieces are important to understanding the results of any survey, but particularly a study on a topic this complex.

Polling industry disclosure guidelines call for full release of these details. The American Association for Public Opinion Research (AAPOR) standards for minimum disclosure include releasing “The exact wording and presentation of questions and responses whose results are reported.” AAPOR’s standards also specify release of “Which results are based on parts of the sample, rather than on the total sample, and the size of such parts.”

For the record, Science Business asked twice for a full report of the survey data, once on 6 October and later on 18 October. Emily Mendell of NVCA responded to our first request saying that the report was still being prepared. Our 18 October request went unanswered.

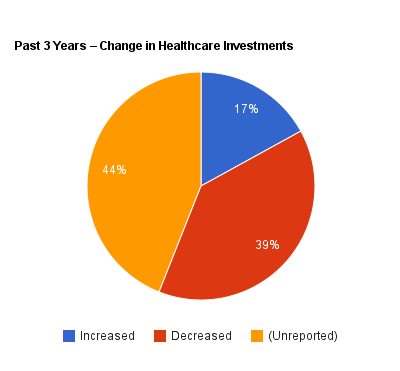

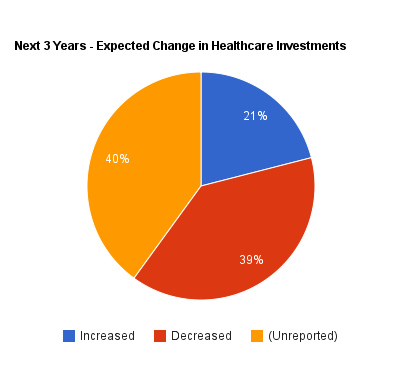

Among the most quoted findings from the survey are that 39 percent of the respondents say they reduced their health care investments in the last three years, compared to 17 percent that increased their investments in health care companies. Along the same lines, the survey asked if companies expected to change their investments in health care in the next three years, with the same percentage — 39 percent — saying they would decrease investments and 21 percent predicting they would increase health care investments.

Only 56 percent of respondents indicate if they invested more or less in health care in the past three years; 44 percent are unreported.

“This is roughly twice the number of firms that have increased and/or expect to increase investment,” intoned NVCA’s press release. That is indeed true, as far as it goes.

Simple arithmetic also shows, however, that NVCA left out large chunks of respondents in drawing that conclusion; see the orange-colored slices on the accompanying charts. For the question on past changes in health care investments, the 39 and 17 percent cited by NVCA only adds up to 56 percent. What about the other 44 percent?

And the 39 and 21 percent reported on changes in future investments totals to 60 percent. What about the other four in 10 respondents to the survey?

Since NVCA has not released a full set of responses or the wording of the questions, one can only guess at what happened to the 40 to 44 percent of the respondents to these critical and much-quoted items. They could have indicated “don’t know” or chose not to answer the questions, but given that responding members had previously invested in health care companies, that would be unlikely.

A more likely scenario is that the questions also asked if respondents made no change in health care investments in the past and planned to make no changes in the future. If the missing 40 to 44 percent made or plan to make no changes in health care or life science investments — a percentage as large or larger than those who reduced or planned to reduce their investments — then the results of the survey would hardly justify the dire conclusions of a retreat from the life sciences.

It’s all the FDA’s fault

Another argument from the survey widely quoted by NVCA and commentators was that the regulatory obstacles imposed by FDA are causing the retreat by VCs from health care. “The survey of more than 150 venture capital firms,” said NVCA’s press release in the second paragraph, “identified Food and Drug Administration (FDA) regulatory challenges as the most significant factor driving away investment from startup companies that are bringing critical therapies to market.”

NVCA drove home this point in a number of ways. Slide number 9 shows 61 percent of respondents indicate “Regulatory Challenges (FDA)” as a factor having the highest impact on VC investment. Just so readers didn’t miss this result, NVCA circled the bar on the bar chart and colored it bright red, to stand out from the other gray bars on the chart.

There is no indication, however, of how the question was worded or to whom it was asked. Was FDA explicitly mentioned in the question or was it phrased as “regulatory challenges” in general? There are, after all, other regulatory agencies VCs encounter besides the FDA.

Also, did respondents choose from a list? Were they restricted in the number of answers they could give? What is that 61 percent based on? Was the question asked to all respondents or to a subset, such as those who invested less in health care? NVCA isn’t telling.

Only 60 percent of respondents indicate if the plan to invest more or less in health care in the next three years; 40 percent are unreported.

The survey asked a similar question on factors contributing to decisions to move investments outside the U.S. On this item (slide 17), “Regulatory Challenges (FDA)” also led the responses, although with a smaller percentage, 38 percent. But again, no wording of the question was given, nor was their any indication to whom the question was asked or how the percentage was calculated.

Another set of questions asked about specific sectors within the life sciences and health care industry where respondents planned to invest. “While 40 and 42 percent of firms expect to decrease investment in biopharmaceutical and medical device companies respectively,” said NVCA’s report/press release, “42 and 54 percent expect to increase their investment in non-FDA regulated healthcare services and healthcare information technology companies respectively.”

One implication here is that dealing with the FDA largely determines a VC’s investment strategy. In the data slides — but not mentioned in the press release — small pluralities of respondents said they increased or planned to increase their investments in diagnostics, and life sciences equipment, two areas with at least some regulation by FDA.

In addition, health care services, while not heavily regulated by FDA, face a raft of regulations from all levels of government, from zoning laws to workplace safety rules to medical waste disposal restrictions. And health care I.T. has a large federal presence, from standards setting to privacy protections. FDA may not be heavily involved in these parts of the business, but many other agencies are having their say.

To its credit, NVCA supports reform of FDA’s regulatory processes, and the survey included a series of items gauging the expected impact on investments of faster and more predictable decisions by FDA. But that support for FDA reform is buried at the end of the three-page press release, along with an acknowledgment that FDA and the White House have already undertaken a set of regulatory reform initiatives.

The survey may also be reporting on perceptions that do not reflect the current state of FDA operations. FDA seems to have sharpened its procedures recently to the point where it approved 35 new drugs in the 2011 fiscal year that ended on 30 September. That’s the highest number of new drugs approved in the past decade, except for 37 in 2009.

Diagnostics, I.T., and precision medicine

NVCA’s crisis campaign seems to have missed another important development in the life sciences, namely the convergence of molecular diagnostics and health information technology with translational medicine. A new report from the National Research Council — part of the National Academies — calls for a new taxonomy of health care at the molecular level to better enable what it calls “precision medicine” that can deliver more personalized therapies to the bedside. The report outlines a framework for organizing medical research and health care delivery that relies to a large extent on advanced molecular diagnostics such as genomics, and standardized electronic health care records.

The council, in other words, views diagnostics, I.T., and health care services as part of the same infrastructure as the discovery of therapies, as opposed to something outside or distinct from therapies. The committee that wrote the report described an “information commons” that links layers of molecular data, medical histories — including information on social and physical environments — and health outcomes to individual patients. As noted below, Google and GE have recently made venture investments in diagnostics start-ups to get in on these types of developments.

Since NVCA released the survey, a number of other findings and analyses point to a less bleak investment environment in the life sciences than portrayed in NVCA’s report, yet still with challenges for VC investors. To begin with, there’s no agreement that VCs are indeed retreating from health care or the life sciences.

Two weeks after the NVCA press release, Dow Jones VentureSource found the number of deals in the third quarter of 2011 to increase for both U.S. biotech/pharmaceutical and medical device companies compared to the third quarter of 2010. The dollar volume of investments declined for biotech/pharma compared to the third quarter of 2010, while investment dollars increased for medical device companies. In fact, U.S. medical device companies attracted more capital ($857 million) than biotech/pharma firms ($715 million).

The conclusions drawn by Jessica Canning, research director for Dow Jones VentureSource, suggest anything but a wholesale retreat by VCs from the life sciences. “Although the biopharmaceuticals sector lost its long-held place as the leader of the health care industry,” says Canning, “early-stage investment was strong, showing that investors are building a pipeline.”

Even NVCA itself reported data showing continued VC support for the life sciences and health care. Two weeks after NVCA issued the Vital Signs press release, John Taylor, NVCA’s head of research, said that corporate venture capital — where companies, such as larger pharmaceutical businesses, invest in start-ups, much like VCs — continues to be a strong player making venture investments. Taylor noted on the NVCA blog that “corporate venture investment is especially prevalent in life sciences” accounting for 23 percent of all corporate VC since the beginning of 2010.

Corporate VC accounts overall for 15 percent of the deals so far in 2011, according to Taylor, and nine percent of the capital. Since July in the life sciences, Baxter International, a maker of medical devices and pharmaceuticals, announced a new venture division, and the venture divisions of GE and Google announced significant investments in health care start-ups developing advanced diagnostics.

The long-term view looks even better

From a longer-range view, industry analysts find over time VC investments in health care and life sciences are still going strong, and if anything, getting stronger. Health care VC Bruce Booth, writing for the Forbes magazine site, shows that since 2001, life sciences have averaged about 26 percent of VC investments, with a standard deviation of about five percent. So far in 2011, Booth found, life sciences investments are at 26 percent of the total, right on average. The dollar volume of $1.6 billion per quarter has also stayed consistent since 2001.

Looking back to the 1990s — the heyday of the Internet boom — life science investments by VCs are also up. Booth says since 1995, life science investments have three times the dollars (no indication if the numbers are adjusted for inflation) and twice the share of total venture capital investments.

Moreover, health care investing has outperformed Internet and technology investments in terms of returns to investors. Booth and fellow health care VC Bijan Salehizadeh wrote for the peer-reviewed journal Nature Biotechnology that life science/health care venture investments dramatically outperformed technology venture investing over the past decade. (Salehizadeh’s blog gives some details from the article that’s behind the Nature firewall.)

Booth and Salehizadeh show life sciences and health care generated average realized returns — where investors get real money in their pockets from mergers or initial public offerings (IPOs) — over the past decade of 15 percent, compared to 5.5 percent for venture capital overall, 3 percent for I.T. overall, and 4.1 percent for software.

The authors also found a lower loss rate for health care/life sciences investments; most venture investments are quite risky and end up losing money. While 58 percent of health care and life sciences companies with VC investments returned less than their invested capital, the percentage for technology investments was much higher: 75 percent. VC investments are not for the faint of heart, but health care and life science companies appear to be less of a crap shoot.

Technology VC investments do better than life sciences and health care in one important respect: IPO performance. Booth and Salehizadeh describe how nearly six in 10 life science companies that had IPOs now have stock prices below their IPO levels, compared to about 30 percent of technology companies. The authors note that I.T. companies that go public are generally more mature with established revenue streams and earnings, compared to biotech, pharma, and medical device companies that often have expensive clinical trials to traverse before their products hit the market.

Clinical trials demand carefully designed and monitored test procedures, often at multiple locations worldwide, and conducting these studies requires deeper pockets than most start-ups can muster. This continued need for investment later in their life cycles makes health care and life sciences companies in today’s environment less desirable when competing against technology companies.

But there are signs of the VC industry responding to this need for later stage financing, including funds for life sciences companies. Sofinnova Ventures in Menlo Park, California announced in October it raised $440 million for investments in later stage health care companies, focusing on clinical-stage drug development. In May of this year, Stage 2 Innovations, announced a $100 million fund for later-stage companies with patents in hand needing financing to take their discoveries to market. Stage 2 Innovations does not focus on particular business sectors.

In the end, health care and life sciences start-ups still have a big advantage over other enterprises, namely the innovative and high-impact nature of their work. The business Web site Xconomy led a tweetchat — an exchange of Twitter messages on a designated topic over a specified period of time — last week with several VCs in the life sciences that captured some of these thoughts.

“[E]nthusiasm for really innovative stuff unbroken! more creative and critical thinking and a higher bar needed for funding, though” said one participant. “Life science folks blaming FDA is like open water swimmer blaming the water,” noted another participant. “Tough luck. Should have been innovative.”

An unintended outcome of the NVCA information blitz, however, is that it could become an unstoppable meme that affects the level of investments itself. “Everyone repeats the news with the same grim perspective,” says Bruce Booth, “and soon enough it just becomes well accepted fact, and runs the risk of being self-fulfilling.”

Read more:

- U.S. Venture Investments Up in Q3, Science Companies Mixed

- Venture Firm Raises $440 Million for Life Sciences

- Survey: VCs Pulling Back from Biopharma, Devices Companies

* * *

RSS - Posts

RSS - Posts

[…] Commentary: Manufacturing the Health Care Venture Crisis […]

[…] Commentary: Manufacturing the Health Care Venture Crisis […]