-

A Good Run

After 13 and a half years, the intersection of science and business remains a compelling subject, but there are other things I now want to do, and it’s time to bring Science & Enterprise to a close.

-

From Freelancer to Business Owner: The Challenges of Growing Your Freelance Venture

Growing your freelancing venture means scaling your workload and taking on new responsibilities.

-

Helping Students Overcome Challenges in Understanding Geometry

This article will explore practical methods for teaching geometry, addressing common difficulties, and providing resources to support student learning.

-

How AI is shaping the health sector: upcoming rules for drugs and medical devices

The upcoming AI regulation for pharma and medical devices aims to ensure the safe and ethical use of AI technologies.

-

High Quality Data Essential for Training A.I. Models

Adding this context to raw data is a process called data labeling, considered a key step in training machine learning algorithms.

-

How can international business risks be overcome?

We will look at the main factors and classifications of risks associated with conducting business activities on the world stage.

-

Troubleshooting Common Issues in High-Performance Liquid Chromatography (HPLC)

High-Performance Liquid Chromatography (HPLC) stands as a cornerstone of analytical chemistry.

-

Fitness 2024: to lose weight or feel good, this is how we will train this year

Awareness of the importance of exercise for psychological well-being is growing.

-

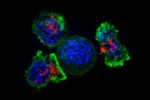

Nanotech Pancreatic Cancer Immunotherapy Gains FDA Fast Track

The developer of an experimental immunotherapy delivering nanoscale payloads to treat pancreatic cancer says the treatment received fast-track status from the Food and Drug Administration.

-

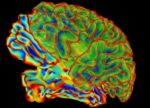

Biotech, Academic Labs Partner on Ultrasound Brain Therapy

A developer of treatments for brain disorders and researchers at Stanford University aim to harness ultrasound to deliver drugs in nanoscale particles to precise regions of the brain.