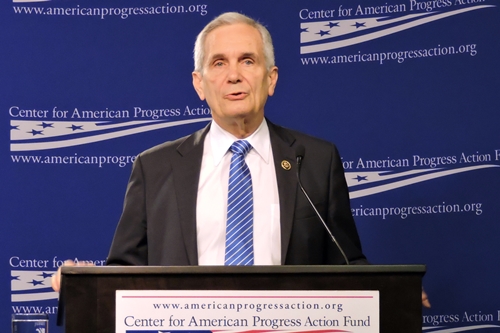

2 May 2016. At a press event in Washington, D.C. last week, Representative Lloyd Doggett of Texas, a champion of lower prescription drug prices, took aim at drug companies and their business practices. “An unaffordable drug is 100 percent ineffective,” Doggett told an audience at Center for American Progress on 26 April. He noted that 9 out of 10 drug makers spend more on marketing than R&D, with Americans spending 12 times more on drugs than people in Ireland, where some American drug companies are trying to escape for lower corporate tax rates.

Doggett, a senior Democrat on the House Ways and Means Committee, was keynote speaker at a panel discussion of a report from Center for American Progress, a progressive think tank in Washington, D.C. Like Doggett, CAP’s report — titled Enough is Enough — called for action by Congress and the executive branch to bring more transparency to drug pricing, and to create pricing models based more on value to the patient than maximizing revenues to the drug companies. The federal government, said CAP’s report and a panel of experts to discuss its findings, can play a larger role in bringing down drug prices, from exercising its buying power through Medicare and Medicaid, as well as leveraging its support for basic life sciences research.

The pharmaceutical industry in the U.S. has a long track record of successfully heading off actions by governments, either by cutting advantageous deals or through lobbying. But calls for doing something meaningful about escalating drug prices are getting louder and angrier, with the industry now left largely alone to fight its legislative battles. And new technologies could make the industries current economic model as outmoded as Life magazine and the Sears catalog.

High prices causing unfilled prescriptions

The panel, chaired by Ezekiel Emanuel, vice-provost at University of Pennsylvania and long-time proponent of health care reform, included Marilyn Tavenner, CEO of America’s Health Insurance Plans, Debra Whitman, chief public policy officer at AARP, and Joshua Ofman, vice-president for for global value, access, and policy at biopharmaceutical company Amgen. Tavenner joined the health insurance industry group in July 2015 after serving in 2013-14 as Administrator of Centers for Medicare and Medicaid Services, in the U.S. Department of Health and Human Services.

The entire panel, including Amgen’s Ofman, the sole industry representative, agreed high drug prices were a problem and cause for concern. Whitman cited recent surveys by AARP of Americans age 50 and over showing more and more difficulty paying for prescription drugs, including 1 in 3 respondents who did not fill a prescription mainly because of its cost. In addition, three-quarters (76%) of American seniors want government to do more to bring down drug prices, about the same percentage of Americans overall cited in CAP’s report that say drug prices are too high.

The panel discussed several proposals in the CAP report and elsewhere to bring more transparency to drug prices, employ comparative effectiveness research to assess the relative value of different treatments, encourage bulk-sale negotiations with government and large insurers, apply success-based outcome models to justify higher prices for drugs, and limit out-of-pocket cost-sharing in health insurance plans. Other ideas included limits on patent lifetimes and bans on pay-for-delay schemes where drug companies pay makers of generic drugs to delay issuing substitutes with lower prices.

Liberal policy wonks at think tanks aren’t the only people pushing these proposals. Many of these same ideas were expressed in an article signed by 118 cancer specialists in July 2015 in the journal Mayo Clinic Proceedings, and in March 2016 by the American College of Physicians in an article in Annals in Internal Medicine. These statements suggest large segments of the physician community aren’t buying the industry’s arguments.

Amgen’s Ofman pushed back on many of these proposals, noting that the costs for developing new drugs are high because the nature of disease is difficult and complex, with Amgen itself spending $4 billion a year on R&D. Thus measuring the value of drugs is also difficult and complex, particularly when bringing in the needs of special populations, like the disabled or children. Applying a single value formula to drug prices, said Ofman, becomes in effect a cost-control, which would have serious market repercussions.

In addition, Ofman pointed out negotiations by insurance plans can bring down costs for some customers, but hospitals still charge full price for non-insured patients. Moreover, Ofman argued, value should be calculated over the drug’s lifetime, including its generic period. Ofman’s arguments resulted in the other panel members accepting, at least in principle, that the issue does not lend itself to easy answers.

Skilled political operators

The pharmaceutical industry in the U.S. seems intent on using these arguments, combined with legislative muscle to maintain the status quo. Doggett noted that pharmaceuticals were largely exempted from government initiatives to bring down health care costs in the Affordable Care Act of 2010, in exchange for the industry’s support for the bill. In a new example, the Obama Administration wants to test value-based pricing models like those used by commercial health plans and pharmacy benefit managers for drugs covered by Medicare. That proposal, however, is receiving little outright support on Capitol Hill, even from Democrats. Jonathan Cohen of Huffington Post attributes the lukewarm reception to effective industry lobbying.

One has to wonder, however, how long this siege mentality can last. Doctors groups, such as American College of Physicians are on record questioning the industry’s pricing policies. And judging by comments supporting much of the CAP report by Marilyn Tavenner, representing health insurance plans, and Debra Whitman of AARP, the pharma industry is losing friends fast.

Perhaps the pharma industry should work more collaboratively with providers, patients, regulators, and payers — including government — to find solutions. One approach from which all parties in the health care community could benefit is a serious effort to find ways of reducing the high costs of developing drugs, with a commitment by drug makers to pass along those savings to customers.

The CAP panel barely discussed the reasons for high drug development costs. CAP’s report devotes 4 of 41 pages to the prescription drug life cycle, where costs of developing new drugs are discussed, as well as arguments disputing industry calculations of those costs. Nonetheless, as the discussion at CAP underscored, there’s really little argument over the risks and complexity of creating new drugs, despite disputes over how they’re calculated.

The industry is no stranger to collaboration

Science & Enterprise asked Ofman after the discussion if there were any industry initiatives now underway to bring down the high cost of developing new drugs. Ofman said the only current industry-wide efforts focused on regulatory reform with FDA, to which he attributed much of the responsibility for high drug development costs.

One model for collaboration is a program in Europe called Innovative Medicines Initiative, a joint undertaking of the EU and the European Federation of Pharmaceutical Industries and Associations that plans to spend €3.3 billion ($US 3.8 million) from 2014 to 2024 on R&D addressing short- and long-term issues in the industry and health care. Funds are contributed about 50/50 between the EU and industry. IMI calls itself the largest public-private partnership in the life sciences

The initiative sponsors a series of R&D projects, each with its own deliverables. Science & Enterprise reported last week on one such project, to develop techniques for smartphones and wearable devices to monitor people with depression, epilepsy, and multiple sclerosis. Some 24 academic institutions, pharmaceutical, medical device, and software companies are taking part in the project. Teams are expected to identify characteristic bio-signatures that track different states of these disorders and predict relapse, develop algorithms for collecting and an infrastructure for analyzing the data collected, and propose privacy and usability factors that encourage remote assessments.

Collaboration in the pharma industry is hardly an alien concept on this side the the pond either. TransCelerate Biopharma is an organization with 18 pharmaceutical companies in the U.S., Europe, and Asia working together to improve the conduct of human clinical trials, which like IMI, sponsors a series of projects where participants share the results. Clinical trials are a major cost factor in the development of new drugs, usually the responsibility of pharma and clinical-stage biotechnology companies.

An industry ripe for disruption

Maybe the pharma industry in the U.S. believes it can tough it out through the current election year, and wait for the rhetoric to cool so it can get back to business as usual. But events may be conspiring against the industry this time, with short-term and long-term consequences.

The short-term problem is an initiative on the ballot in California this fall known as the California Drug Price Relief Act. The initiative calls for the State of California to pay the same prices for drugs as those negotiated by the Veterans Administration, an agency with permission to negotiate its drug prices. Pharmaceutical Research and Manufacturers of America, the industry lobbying group in the U.S., reportedly raised $49 million to oppose the measure. Should the initiative pass, it is easy to imagine other states and eventually U.S. agencies following suit.

The long-term problems could be even more consequential. The pharma industry is setting itself up for Silicon Valley-style disruption, with some of the big technology companies now testing the waters. The combination of electronic health records, smartphones, miniaturized medical devices, 3-D printing, cloud computing, artificial intelligence, lower costs for genomic sequencing, and big data analytics are creating new types of treatments designed and delivered for individual patients, vastly different from the current model of mass-produced medications.

This type of individualized, personal delivery is an environment where the technology industry excels, with established tech companies getting into the act. Amazon Web Services is now a major provider of cloud computing to the health care industry. Apple Computer offers its ResearchKit, for life sciences data collection with smartphones. Google and drug maker Sanofi are collaborating on so-called smart contact lenses with sensors to detect and measure glucose levels in tears that can help determine insulin doses for people with diabetes.

It’s hard to tell what these new disruptive technologies will look like, but here are two possibilities. An MIT chemical engineering team reported in March developing a prototype small-batch drug manufacturing unit. The continuous-flow drug manufacturing system, about the size of a refrigerator, was designed to produce small batches of drugs needed in remote regions or to fill spot shortages, apparently a chronic problem in the industry. Current large-scale manufacturing processes, say the developers of the system, don’t work well for drugs needed in smaller quantities, such as those treating rare diseases or for clinical trials.

The other example, from a joint bioengineering lab at Harvard and MIT and reported in April, is a biodegradable film loaded with drugs that in lab mice delivered chemotherapy directly to the pancreas, an organ where cancer is often difficult to treat. The film is first loaded with enough chemotherapy drugs for 60 days, and programmed to release the drugs over that period. In addition, the device emits the drugs only from the side of the film facing the tumor, to limit damage to other organs.

The track records of companies like Amazon, Apple, or Google show they have no qualms about destroying current business models; just ask book or music publishers. The pharmaceutical industry can shape its own future in this environment, or have others do it for them.

Read more:

- Sanofi Adopting Big Data for Diabetes Drug Adherence

- FDA Assessing Opioid Regulatory Reviews, Labeling

- Medical Industry Payment Recipients Identified

- FDA Proposes Guidance, Rule on Biosimilar Naming

- Antipsychotic Drug Savings Expected as Patents Expire

Disclosure: The author owns shares in Pfizer and Johnson & Johnson.

* * *

RSS - Posts

RSS - Posts

[…] Drug Pricing Reform Even Big Pharma Might Like. 2 May 2016 […]