15 April 2015. Aduro Biotech Inc., a developer of immunotherapies to treat cancer, issued its initial public stock offering today that expects to net the company some $108 million, after issuing 7 million shares priced at $17.00. The Berkeley, California enterprise trades on the Nasdaq exchange under symbol ADRO. As of the Nasdaq closing bell at 4:00 pm ET today, Aduro shares were priced at $41.06.

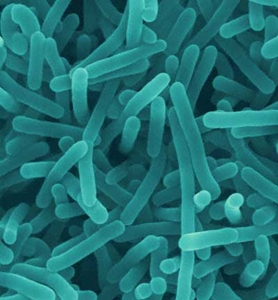

Aduro’s immunotherapy technology creates therapeutic vaccines from an engineered form of listeria bacteria targeting specific tumor cells. Listeria, in its natural form, is a bacterium associated with food poisoning, but in the lab can be weakened and engineered to safely deliver antigens stimulating an immune response. Aduro calls its listeria-based cancer antigens live, attenuated, double-deleted or LADD agents, which the company says can work alone or with other cancer treatments, including chemotherapy.

An emerging technology at Aduro harnesses cyclic dinucleotides, naturally occurring molecules, found in both bacteria and mammals, but in mammals activate a signaling mechanism in immune-system cells. When stimulated, this pathway, known as Stimulator of interferon genes or Sting, induces production of cells and proteins that support and amplify the immune system.

The company says its engineered cyclic dinucleotides are more potent in stimulating the Sting pathway than the naturally-produced variety, to encourage a response in T cells, key immune system cells. In tests with lab animals, the company reports injections of its cyclic dinucleotides directly into tumors, sharply inhibited growth of melanoma, colon, and breast tumors, and protected against regrowth of those tumors as well as spreading of cancer cells.

In March, the pharmaceutical company Novartis licensed Aduro’s cyclic dinucleotide technology for commercialization outside the U.S. in a deal with a potential total value to Aduro of $750 million. Part of the deal includes Novartis taking a 2.7 percent equity stake in Aduro, with the option for expanding that stake later on.

Aduro has immunotherapies in early or intermediate-stage clinical trials being tested as treatments for pancreatic cancer, mesothelioma, and glioblastoma multiforme, an aggressive brain cancer.

Read more:

- Novartis, Aduro Biotech Partner on Cancer Immunotherapy

- Immunotherapy Biotech Raising $45 Million in IPO

- Amgen, Kite Pharma Partner on Personal Cancer Immunotherapy

- Personalized Leukemia Immunotherapy Gets 90 Pct Remission

- Biotech Company Licenses Caltech Immunotherapy Research

* * *

RSS - Posts

RSS - Posts

You must be logged in to post a comment.