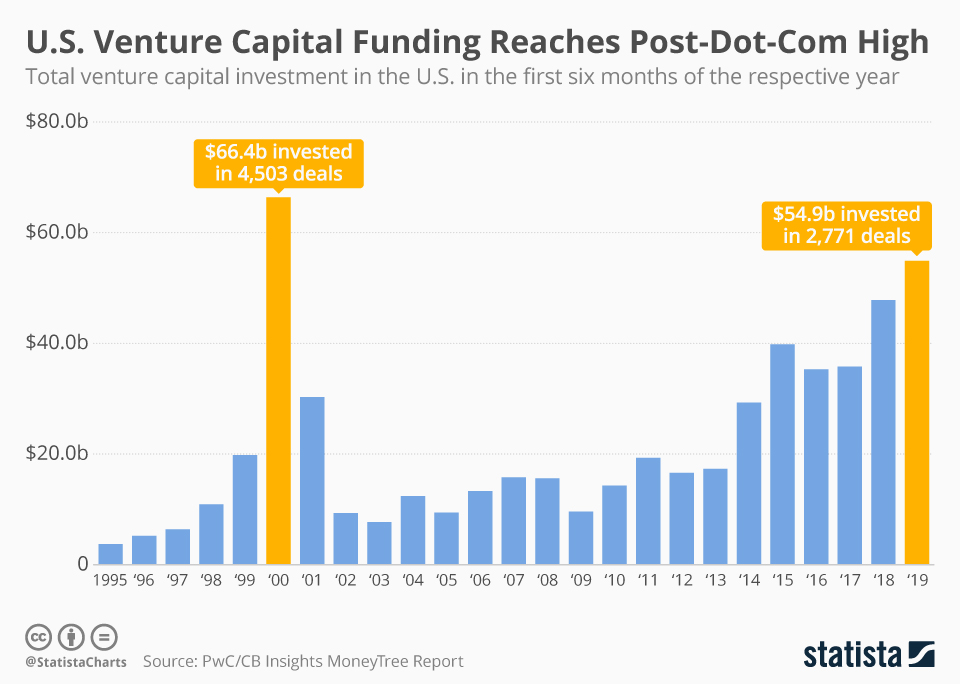

19 July 2019. Total venture capital funding in the U.S. for first six months of 2019 reached levels not seen since the year 2000, the waning days of the dot-com era. According to the latest MoneyTree Report published by PWC and CB Insights, and charted by our friends at Statista in this week’s infographic, venture financiers invested $54.9 billion in the first half of this year, the highest first-half funding level since $66.4 billion invested in 2000.

The MoneyTree Report says Internet companies gained most of these venture funds since the start of 2019, bringing in $22.6 billion, followed by health care companies raising $8.8 billion and mobile/telecommunications enterprises with $5.9 billion. However, the report also shows the number of investments dropped to the lowest level since 2013, indicating larger venture deals than before. In fact, 112 deals of $100 million or more were recorded in the U.S. from January to June 2019. We’ve listed below a few of those so-called mega-deals reported by Science & Enterprise.

Our infographic appears a day early this week, since we’ll be taking a break until the end of July. We’ll have more about that in a later post today.

More from Science & Enterprise:

- Stem Cell Start-Up Raises $250M in Venture Funds

- Liquid Biopsy Screening Start-Up Launches, Gains $110M

- Viral Disease Biotech Joins ElevateBio, Gains $120M

* * *

RSS - Posts

RSS - Posts

You must be logged in to post a comment.