20 Nov. 2021. If it seems Science & Enterprise reports a lot about venture funds for start-ups in California, New York, and Massachusetts, you’re right. As CB Insights notes, the metro areas in the U.S. attracting the most venture capital dollars and deals in the third quarter of 2021 are San Francisco/Silicon Valley, New York, Los Angeles, and Boston.

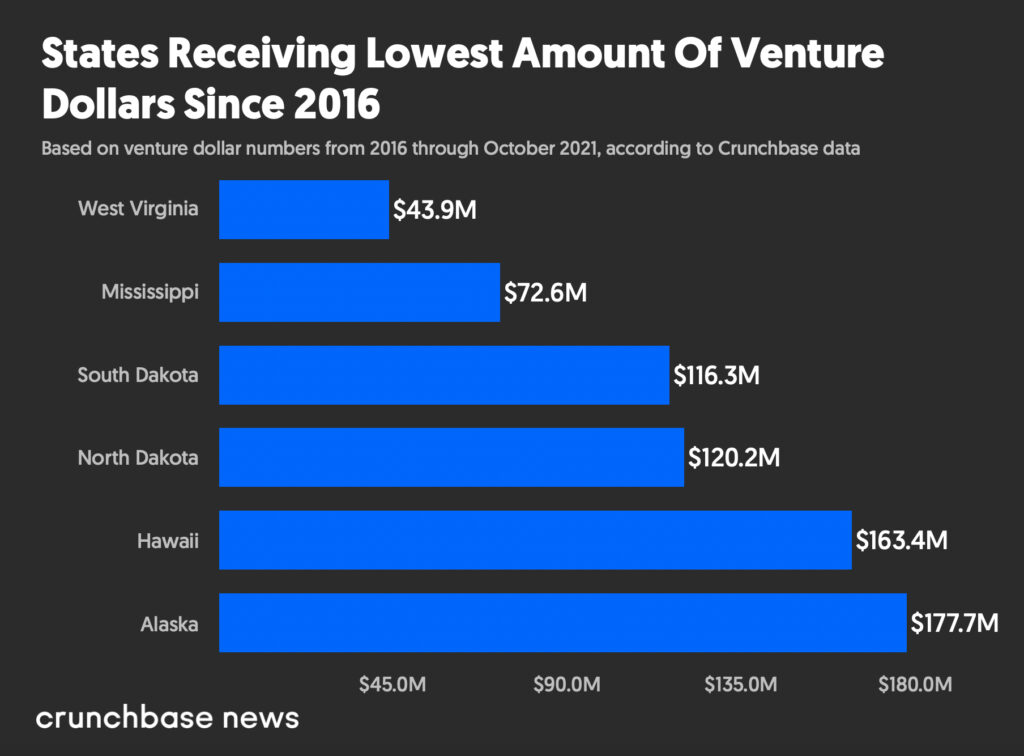

On Thursday, Crunchbase News reported on parts of the U.S. getting the fewest venture dollars, displayed in today’s infographic. In the past five years, start-ups in West Virginia attracted a total of $44 million in venture funding, with Mississippi companies receiving nearly $73 million in that time. By comparison, says Crunchbase, California businesses gained $120 million in venture financing in just the first three quarters of 2021 alone.

Crunchbase News talked to Tony James, CEO of a group promoting tech innovation in Mississippi, to learn what’s holding back venture funding in his region. James tells Crunchbase News, new tech companies may get started in Mississippi, only to move to places like San Francisco, to find venture money and talent, as well as live the Silicon Valley lifestyle. “The question becomes: Can companies effectively grow here,” says James. “That’s what this really will come down to.”

More from Science & Enterprise:

- Infographic – Q3 2021 Venture Funds Continue Banner Year

- Infographic – Few Venture Dollars for Women Founders

- Infographic – 2021 Black Start-Up Funding Rises

* * *

RSS - Posts

RSS - Posts

You must be logged in to post a comment.