4 Feb. 2023. Venture capital investments by corporations in start-ups declined globally in 2022, but remained at historically high levels, while the number of deals stayed about the same as 2021. The technology intelligence company CB Insights reported the data on corporate venture capital or CVC investments last week (registration required).

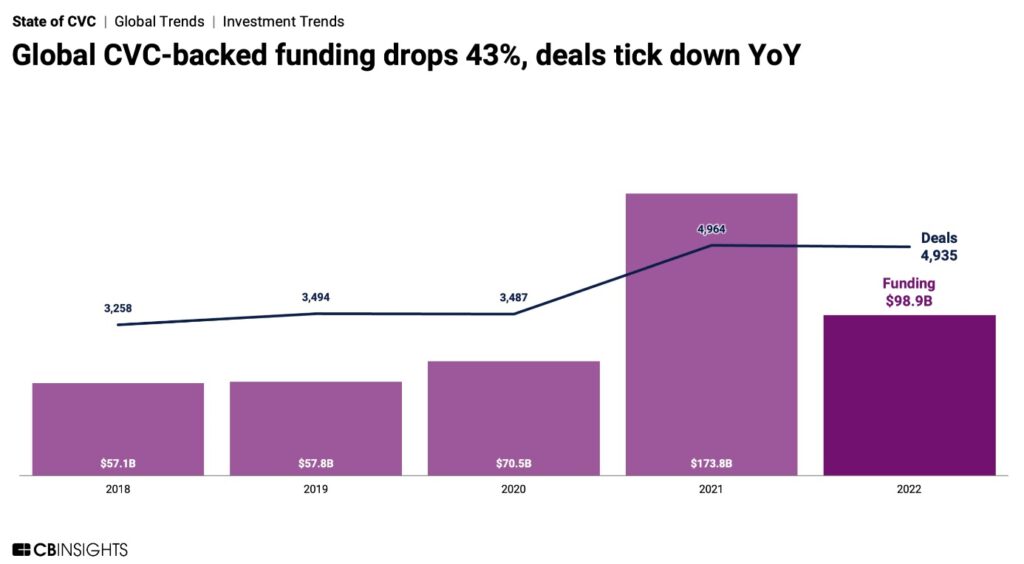

Large corporations make venture investments for the prospect of high financial returns, like other investors, but also for strategic reasons, particularly to gain access to key technologies and markets. CVC investments make up about eight percent of all venture capital placements in start-ups each year. Compared to the record previous year, total CVC investments dropped 43 percent to $98.9 billion in 2022 from $173.8 billion in 2021. That 2022 total for CVC investment dollars is still higher than the $57-$71 billion invested each year from 2018 to 2020.

The total number of CVC transactions fell only slightly in 2022 to 4,935 from 4,964 in 2021, with total 2022 CVC deals still higher than the 2018 to 2020 annual totals. CB Insights warns, however, that the numbers may not be cause for optimism in CVC investments. The report says total investment dollars from CVCs declined each quarter in 2022, reaching $14.3 billion in Q4.

While corporate investors generally made smaller start-up investments in 2022, early-stage deals — defined by CB Insights as seed- and series A or first-round deals — increased seven percent compared to 2021. Companies in the U.S. remained the leading recipients of CVC investments last year. CVCs making the most deals last year were Google Ventures, Citi Ventures, and Coinbase Ventures, all investing in U.S. start-ups.

More from Science & Enterprise:

- Infographic – Digital Health Venture Funds Crater in Q4 2022

- Infographic – 2022 Biotech Venture Funding Weakens

- Infographic – Mixed Signals on 2022 Venture Funding

We designed Science & Enterprise for busy readers including investors, researchers, entrepreneurs, and students. Except for a narrow cookies and privacy strip for first-time visitors, we have no pop-ups blocking the entire page, nor distracting animated GIF graphics. If you want to subscribe for daily email alerts, you can do that here, or find the link in the upper left-hand corner of the desktop page. The site is free, with no paywall. But, of course, donations are gratefully accepted.

* * *

RSS - Posts

RSS - Posts

You must be logged in to post a comment.