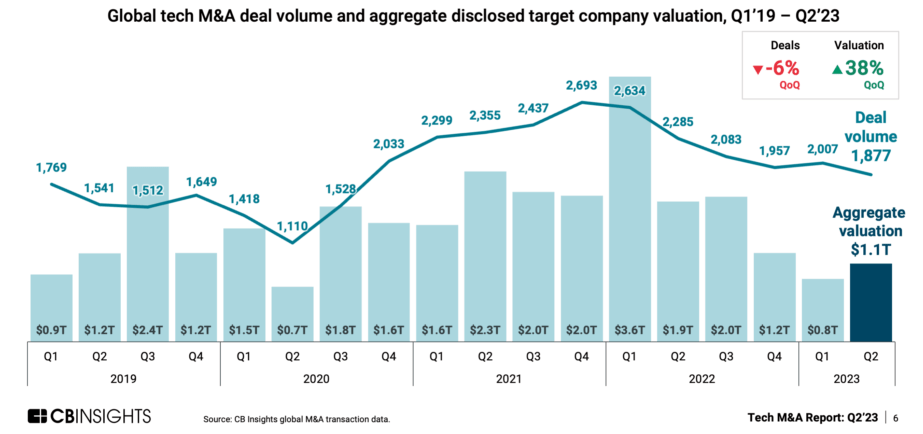

17 Sept. 2023. The value of mergers and acquisitions in the global technology sector rose for the first time in over a year in the second quarter of 2023, while M&A deal counts dropped somewhat. The data, reported earlier this month by technology industry intelligence company CB Insights (registration required), show merger and acquisition valuation and deal numbers in the tech industry worldwide have returned to about the same levels as before the Covid-19 pandemic.

CB Insights reports tech industry M&As worldwide totaled $1.1 trillion from April through June 2023, an increase of 38 percent from the first quarter total of $800 billion. As the chart shows, the second quarter gain in M&A valuation is the first sizable increase since the first quarter of 2022, when the sector recorded a monster $3.6 trillion in deals. At the same time, the number of global tech industry M&A deals in Q2 2023 fell by six percent to 1,877 from 2,007 in Q1. Nonetheless, these quarterly valuation and deal totals are roughly the same as reported in 2019, before the onset of Covid-19.

The reports also indicates tech industry merger hunters are favoring larger acquisition targets. CB Insights says the number of tech M&A targets valued at $1 billion or more rose by 21 in the second quarter, while the median valuation of those targets nearly doubled to $45 million, the first gain in three quarters. And 41 percent of tech industry M&A targets valued at more than $100 million in Q2 were in the U.S. In addition, the median number of employees at tech companies acquired in Q2 rose to 359, rising sharply from 214 in Q1, and after falling for three straight quarters.

More from Science & Enterprise:

- Regeneron Acquires Hearing Loss Biotech in $213M Deal

- Computational Drug Discovery Company Acquires A.I. Businesses

- Cell Biology Tools Companies Merge in $57.8M Deal

We designed Science & Enterprise for busy readers including investors, researchers, entrepreneurs, and students. Except for a narrow cookies and privacy strip for first-time visitors, we have no pop-ups blocking the entire page, nor distracting animated GIF graphics. If you want to subscribe for daily email alerts, you can do that here, or find the link in the upper left-hand corner of the desktop page. The site is free, with no paywall. But, of course, donations are gratefully accepted.

* * *

RSS - Posts

RSS - Posts

You must be logged in to post a comment.