25 April 2014. Juno Therapeutics, a biotechnology start-up company in Seattle, completed its first round of venture financing, raising $176 million from private investors and not-for-profit research institutes. The company started in December 2013 with a stake of $120 million, but announced in January 2014 it planned to expand its financing beyond an original target of $145 million.

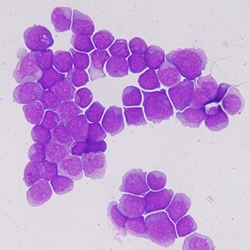

Juno is developing therapies for cancer that harness the body’s immune system, specifically the white blood cells known as lymphocytes or T-cells that provide an enduring level of protection against invading pathogens over time, much like vaccinations. Targeting cancer cells, however, with this strategy needs to distinguish healthy from cancerous tissue, as well as avoid triggering an auto-immune response that creates a damaging adverse reaction by mistakenly fighting an absent invader.

The company plans to develop therapies for blood and solid tumor cancers, through clinical testing to FDA approval. Its technology platform is designed to synthetic receptors or enhanced receptors on antigen targets that reprogram memory T-cells to attack targets on the surface or inside cancer cells. By precisely targeting and attacking cancer cells, the reprogrammed T-cells have the potential to treat cancer without the risks associated with current methods, such as surgery, chemotherapy, and radiation.

Juno was founded by the Fred Hutchinson Cancer Research Center in Seattle, Memorial Sloan-Kettering Cancer Center in New York, and Seattle Children’s Research Institute, with researchers from all three institutions serving as founding scientists. The company’s initial financing in December 2013 came from the founding institutions, as well as venture capital firm ARCH Venture Partners and the Alaska Permanent Fund, through a partnership managed by hedge fund sponsor Crestline Investors.

The company says the expanded financing adds funds from Bezos Expeditions, the investment company of Amazon.com founder Jeff Bezos, and the venture capital company Venrock. Juno’s original backers also contributed to the expanded funding round.

Read more:

- Biopharma, University Partner on Blood Cancer Immunotherapy

- MedImmune, Biotech to Partner on Cancer Immunotherapies

- Start-Up Licenses UMass Cancer Immunotherapy Technology

- Roche, Biotech Ink Cancer Vaccine/Immunotherapy Deal

- Bayer, Compugen to Partner on Cancer Immunotherapies

Hat tip: Fortune/Term Sheet

* * *

RSS - Posts

RSS - Posts

You must be logged in to post a comment.