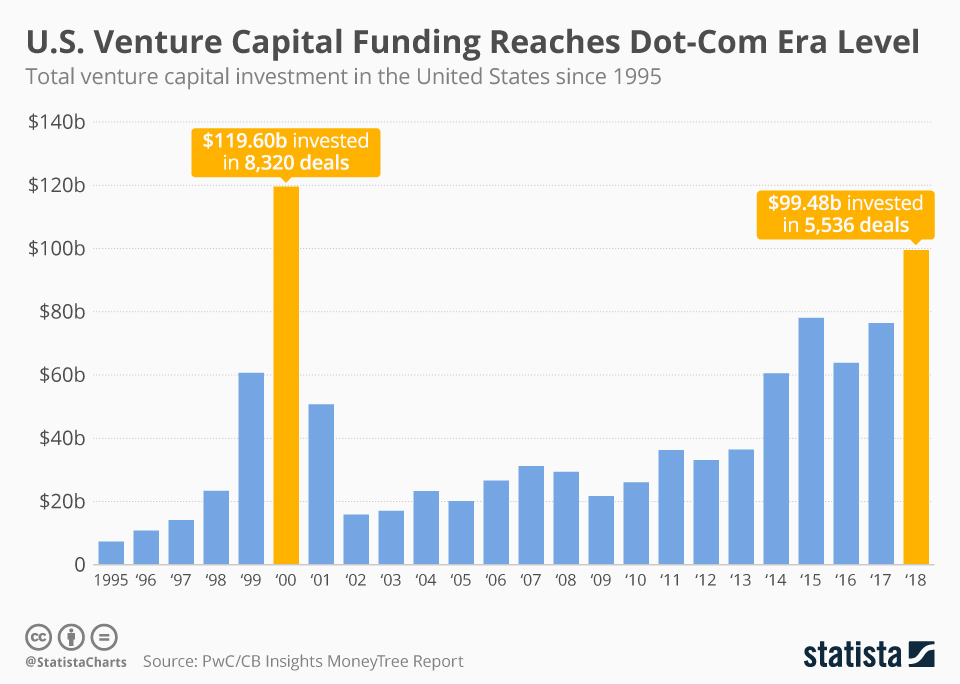

12 Jan. 2019. Venture capital investments in the U.S. during 2018 reached the highest levels since the height of the dot-com era, as shown in this weekend’s infographic. Venture funding last year totaled $99.5 billion, the largest annual outlay since 2000, when financiers invested $119.6 billion, according to the quarterly MoneyTree Report, and reported yesterday by our friends at Statista. The MoneyTree Report is a joint project of the accounting and consulting firm PwC and technology market research company CB Insights.

Internet services received the largest share of investments, totaling $36.7 billion, while health care companies attracted $20.3 billion and mobile-telecommunications enterprises brought in $14.8 billion last year. Recent examples listed below, reporting on venture funding for companies commercializing scientific research, show the scale of those investments. Venture capital is, of course, a topic followed by Science & Enterprise since we began.

While total dollar investments are reaching dot-com era levels, conditions today may be different from those frenetic days. According to the experts analyzing the data, the higher volume of investments is made up of larger deals going to later-stage companies, rather than start-ups with “.com” in their names. Thus, say the analysts, there’s less chance of an investment bubble than in 2000.

More from Science & Enterprise:

- Drug Discovery Start-Up Gains $400M Financing

- RNA Therapeutics Company Raises $30M in First Venture Round

- Start-Up Developing Immunometabolism Therapies, Gains $30M Funding

* * *

RSS - Posts

RSS - Posts

[…] Jan. 2019. Yesterday, we reported on 2018 being a banner year for venture capital, with $99.5 billion invested in start-up enterprises, the largest annual total since the dot-com era. But according to the New […]

[…] was a banner year for venture capital, with $99.5 billion invested in start-up enterprises, the largest annual total since the dot-com era. But according to the New […]